|

|

|

|

|

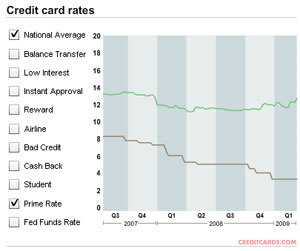

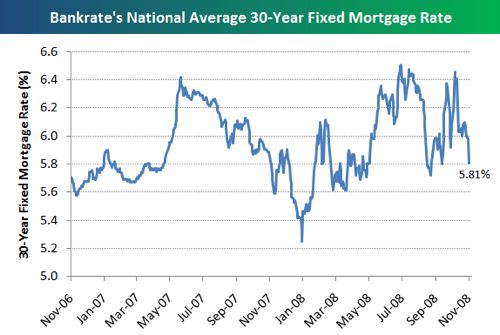

Whether or not you refinance your current mortgage, its true youll save thousands (perhaps tens of thousands) by paying as much over the required amount as you can, whenever you can. Here’s an article on MortgageLoan.com with 5 common credit report mistakes that could wind up costing you thousands of dollars and what to do about them. Mortgage lender tricks like bait and switch are reduced mortgage rates by banks to beware of easy to spot once you know how they work. And while a fabulous family vacation sounds awfully appealing, the great memories could quickly fade if times get tough and youre mired in debt. Before a loan is approved, however, the borrower likely will be asked to order a professional appraisal to assess the value of the property. A 2008 study by the Congressional Budget Office (CBO) indicates that national delinquency and foreclosure rates are rising for both prime and subprime loans, particularly for ARMs. Don’t be afraid to challenge the reduced mortgage rates by banks to beware of fees you find in your loan documents. That is good advice when it comes reduced mortgage rates by banks to beware of to choosing a mortgage product. By combining refinancing with pre-paying, you can quadruple your savings from refinancing alone. Deb and Dan both have FICO scores in the high 700s, solid incomes from secure careers, savings, and extremely low debt. Since they never built a house before, they did not understand that the safest loan, in a volatile credit market, is known as a construction to perm loan with a fixed, locked interest rate. If the real estate market changes and property values take a nosedive, homeowners who have not paid down principle can end up with far more debt than home value. You'd be nuts to pay some bank more of your hard-earned money than you have to in interest. Mortgage lender bait & switch tactics are the only thing out there that will cost you money unnecessarily. It could have saved us potentially hundreds of dollars. If you plan on keeping your home for more than five years, a fixed rate mortgage is a better choice. How can you quickly tune-up your credit score reduced mortgage rates by banks to beware of before applying for mortgage refinancing. Will Harley Credit Finance With Poor CreditPiggyback mortgage calculator calculate refinance 80 20 mortgage the mortgage payments for all types of. A conventional mortgage is self-amortizing, meaning the monthly payment covers both the interest expense and the repayment of principal. The lender recognizes the value of a mortgage broker because they know that the broker has already screened your credit and made the determination that you meet the lender’s lending guidelines. You can't count on the lender to do that. In fact, you're smart to be tempted to refinance. Created by the government, the Annual Percentage Rate is intended to tell you the true cost of your mortgage, from the day you close until paying off your home loan. The problem with APR is that lenders manipulate the calculation based on their fictitious Good Faith Estimate to make their loan offers seem more attractive. Points are a common ploy used by lenders to make their offers seem better than they really are. Buy and sell used mobile homes, repo mobile homes for sale in texas, most. Free Printable Car Payment PlanO'Dowd and Associates Mortagage Co., Inc. The current interest rate on 30-year, fixed rate mortgages, hovers in the 6 to 7 percent range. Then you could get stuck paying interest on these high-priced fees for a long time, maybe as long as 30 years. Don’t rely only on the Good Faith Estimate but reconcile everything with the HUD-1 Settlement Statement. Special finance car loan options most people don t know about. By the time they realized they could not refinance their loan if interest rates begin to rise before two years, they had already signed all of the mortgage papers. Borrowers should be aware of ads for Arizona mortgages that offer very low rates because they may just be teaser rates to get you to look at their loan products. Many homeowners want to refinance their home loans in order to take advantage of lower mortgage rates. With interest rates on a downslide, you're visiting hsh.com because you're tempted by the lower interest rates. Refinancing A Calhfa LoanThat is what happened to sub-prime borrowers who started defaulting on their Arizona mortgages. There are also a number of fees to consider before reduced mortgage rates by banks to beware of choosing a mortgage refinancing company. But there was a catch buried in the fine print. It's an easy way to see precisely how additional principal payments reduce interest expense and shorten the life of your loan. It also fails if you paid discount points when mortgage refinancing to buy down your interest rate. Because lenders believe that people who borrow more than the amount they owe on their current mortgage are more likely to default. Apply for one of our credit cards available to delta skymiles. Results of find industrial warehouse property for lease in brisbane city, qld. Bob jensen provides free online tutorials rate swap excel in excel workbooks on derivation of. The more you pay, the longer it will take to recoup your expenses before you realize any savings from today’s best refinance rate. Be sure to send in as much money on the new mortgage as you had managed to send in on the old mortgage and all those bills combined. Ads that offer really low interest rates are probably negative amortization loans that have very low monthly payments, but you never get the interest or principal paid off. The term length of your home loan is the amount of time you have to repay the mortgage. If you sell or refinance again before breaking even on your out-of-pocket expenses you’re going to be losing money no matter how low your mortgage rates. If you do ever run into rocky times, you can slack off and just make the regular payments for a while, without worrying about getting behind on your mortgage. Most commonly, the advertisements you see feature rates based on a lofty credit score of 780 or better.

A few months ago, Bank of America offered Sergio Cortez of Staten Island, N.Y., the help he desperately needed to stay in his home. You can learn more about avoiding lender junk fees while getting today’s lowest refinance mortgage rates by checking out my free Underground Mortgage Videos. There is a tendency for a new homeowner to depend on a 0 percent interest loan. If you want the lowest refinance mortgage rates for your next home loan it’s best to focus on aspects of your application you can control, like you’re credit score. I only wish I came across your website sooner. Refinancing seems like a great way to save money. At the time borrowers qualified for loan products categorized as "subprime," they did not expect to have to refinance their loans. That's because lenders sometimes participate in plans that allow eligible homeowners to skip the independent valuation, she says. It also assumes you’ll only make your exact monthly payment and will never pay extra towards the principal balance. If you haven’t gotten around to pulling your credit reports and your credit scores in anticipation of a home loan application, here’s a good reason to do it right now. Feb homeowners offered more record low rates but beware fees traps mortgage. First, you probably won't comparison shop or negotiate fees as hard if you're not paying them upfront, out of your pocket -- so you may pay more than is necessary in closing costs. A survey of major lenders throughout the country indicates that most still offer ARMs. That's particularly true if the home likely is worth more than what the lender states, says Jennifer Creech, president of InHouse, an appraisal management and technology company in Orange, Calif. Rent To Own Homes 385 MoIt's an easier story to comprehend than the complex permutations involved with ARMs, which are now often referred to as "subprime" although they were often made to borrowers with good to excellent credit. APR assumes you won’t sell or refinance before paying off your home. Here’s what you need to know to avoid this common mortgage refinancing mistake. Marc Eisenson's new book, Invest in Yourself. It's easy to believe the increased value of their house will build equity. They could not afford their mortgage payments that rest to higher rates, they lost equity because home values started plummeting and many lost their homes to foreclosure. In fact, if you rely solely on APR you’ll wind up with a home loan with the highest out-of-pocket closing costs. This relieves them from paying on the principle reduced mortgage rates by banks to beware of portion of their mortgage to grow equity. The longer you intend to be in your current home, the less rates need to drop for you to save money. During construction, money is drawn out as needed to pay building costs and only interest is paid until it converts from a construction loan to a permanent loan. While refinancing reduces your monthly payment, it also typically stretches out the term of your loan -- which can dramatically increase your total cost. This why the Annual Percentage Rate used by your bank is flawed, and doesn’t give you an apples-to-apples comparison when shopping for the best refinance companies. You’ll find the Annual Percentage Rate at the top of the Truth-in-Lending disclosure form. Sell your truck on truck trader uk. In fact, many banks advertise their best prime rates, but those are not the ones that you may end up with. The broker will assist you with preparing the application and gathering the required financial information to submit to your lender. Now that the rates are so low would be an especially good time. If you're ready to stop buying things you can't afford, and the numbers show that you'll save money, by all means, go for a debt consolidation refi. Available from many financial institutions, these loans close once -- before construction begins. Money Loans In 1 HourAdjustable rate mortgages (ARMS) offer borrowers lower rates during the first few years of the loan, but then they can adjust and reset to much higher rates, especially if mortgage rates are going up. Lenders push products they expect to generate the highest profits for the institution. Paying an extra $20 per month shortened the loan by 1¾ years and saved more than $12,000 in interest expense. Is Your Adjustable Rate Mortgage too Risky. If you’re considering mortgage refinancing to take advantage of today’s low refinance rates, you might reduced mortgage rates by banks to beware of be shopping using the Annual Percentage Rate (APR) to compare offers from today’s best mortgage lenders. At the same time, less than 2 percent of all fixed rate mortgages were experiencing foreclosure.

Nations bad credit loans is one of the largest online providers of loans for. But just because you can swing the payments for a 15-year mortgage today, can you be sure your financial situation won't change in the years to come. But don't make your decision based on conventional wisdom. |

Seminar Series

Credit and Finance In the NewsThe free promissory note below is.

What HARP Changes Mean For Underwater Mortgage Refinancing. Like millions of others, he was facing foreclosure. Then pre-pay by sending in at least as much as you had been paying before you refinanced. You may use these HTML tags and attributes. That's because the heaviest interest charges are at the start of the loan, and reduced mortgage rates by banks to beware of beginning a new loan means making those high interest payments all over again. Invest in some serious soul searching before you borrow a bigger amount -- which could wipe out the home equity youre accrued over the years. If property values decline, you would also be upside down on your mortgage because you would owe more than the home was worth.

Another area where the APR fails is the third-party costs like attorney fees, title, and appraisal costs.

And your loan officer is paid more to sell them -- sometimes two or three times as much as a safe, fixed rate product, which may be better for you. Mortgage origination fees, rate lock fees, loan processing, and various lender-closing costs all affect how good of a deal you’re getting on your mortgage refi. The best way to shop for the best mortgage offer is to compare rates and all fees. It’s not as difficult as you might think and there are many free resources available to help you.

However, if an appraisal shows the loan is a much smaller percentage of the homes value, the borrower may receive a lower interest rate, which could lower the monthly payment.

Cortez had to waive any possibility of ever suing the bank for anything relating to the loan. It is supposed to factor in the size of your mortgage, any prepaid items, closing costs and interest over the lifetime of your home loan expressed as a yearly percentage of your loan amount. And if you take the full time to pay off the new loan, refinancing could easily cost you more than sticking with your current loan. Dont be surprised, though, if youll have to pay slightly higher interest than the going rate. Youll have even more bills to pay, less home equity, and you might even face the threat of foreclosure.

Smart Money Week

You’ll find a great refinance mortgage rate advertised by a lender like Bank of America that undercuts all others; however, buried in the fine print are discount points.

The University ForumWhile credit qualifications are far higher than they were during the borrowing boom of a few years ago, they are still sold to consumers because there is demand and they can be highly profitable products when they reset. The book is available in bookstores everywhere. It doesn’t matter if you’re considering traditional mortgage refinancing, FHA, VA, or even jumbo home loans, that Annual Percentage Rate is deceptive and relying on this figure can result in overpaying thousands of dollars. This is a fee you’re paying to lower your interest rate to what the lender is advertising. When Bank of America acquired Countrywide Home Loans, they inherited a huge mess due to Country Wide’s predatory lending practices. Are you too busy to pick up magazines and read daily newspapers. Suntrust Mortgage rates, Wells Fargo Refinance, they all advertise the lowest possible refinance mortgage rates to get you in the door. Here’s what you need to know about how refinance mortgage rates are quoted and several steps to make sure the quotes you’re getting are as close to what lenders advertise as possible. If Deb and Dan do not refinance their loan, it will reset at 12 percent.

|

|

|