|

|

|

|

|

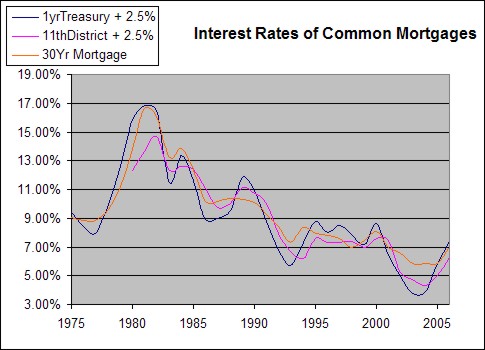

Links to various sites can be found at http. Copyright © 2007-2012 Bionic Turtle. Also see basis adjustment and short-cut swap valuations in excel method for interest rate swaps. In practice, investors and auditors often rely upon the Bloomberg swaps curve estimations. We have some concerns as to whether the FASB s swap values are theoretically sound, but that issue is reserved for another paper. Example 5 of FAS 133 is supposed to provide an example of accounting entries for a receive fixed/pay variable interest rate swap that that effectively hedges the variable interest income from an investment. Dec my husband i are wanting to buy a double wide financing doublewide mobile home on a basement. Custom Interest Rate Swaps swap valuations in excel Having No Market Trading. The interest rate for a specific forward period calculated from the incremental period return in adjacent instruments. Term structure is an empirically observed phenomenon swap valuations in excel that yields vary with dates to maturity. The swap values at the reset dates in the table on page 75 are the present values of future expected swap cash flows that are discounted at rates in the unknown yield curves. The cash flows that are discounted to the present value at each reset date cannot be known without the yield curves and the forward rates that are used to calculate the future quarterly expected cash flows. As before, the entry for Effect of change in rates is also adjusted. With regard to Example 5 on pages 72 76 of FAS 133, which is supposed to demonstrate the mechanics of accounting for a cash flow interest rate swap, we contend that information necessary for understanding Example 5 was omitted and that the table on page 75 of FAS 133 contains a repeating error that that confounds attempts to understand the development of the example. Thus, for holding periods that cover very short time spans, this stylized fact allows simplification of the preceding formula into the following approximation. That forward coupon rate, which is different from the forward (spot) rate, is 6.86%, computed from the term structure of interest rates shown above. For example, during the five years from 1993 through 1997, 99% of week-to-week variability in 10-year swap rates derived from variability in the 10-year Treasury yield. This may also be called tracking error, correlation risk in some applications. You can also go to the Kawaller & Company website to find the following. Chrome Factory WheelsIt results in the fair value of the debt being equal to par at its issuance. In an economic expansion accompanied by inflation, interest rates tend to rise and yield curves shift upward and rotate indicating that short-term rates have increased more than long-term rates. The flat yield curve assumption for Example 2 allows readers to follow the example without information beyond that provided in our earlier paper, but the upward sloping yield curve assumption in Example 5 requires disclosure of the yield curve at each reset date in order to verify the swap values and understand the example. Because of changes in interest rates and because of the passage of time, the present values of expected swap cash flows change each quarter. The present value of the second swap cash flow of $19,265 is $19,265/(1.01432) or $18,725, and so forth through the remaining six quarters. Apply for cash back credit cards at. Other than providing the assumption that the yields in the yield curves are zero-coupon rates, the FASB offers no information that would allow us to derive the yield curves or calculate the swap values in Examples 2 and 5 in Appendix B of FAS 133 and in other examples using FAS 138 rules. Some college programs have Bloomberg Terminals that allow students to perform real-world simulations --- http. If time is plotted on the abscissa, the yield is usually upward sloping due to term structure of interest rates. It is the price tag on the actuarial risk that one of the parties to the swap will fail to make a payment. Since the swap values are assumed to be correct in the original table, Effect of change in rates is adjusted also by the correction. The different shapes of the yield curve described above complicate the calculation of the present value of an interest rate swap and require the calculation and application of implied forward rates to discount future fixed rate obligations and principal to the present value. When it is properly implemented both valuation methodologies give the same value as the first method employed by you. Per the example on pages 435-437, the fixed payments for the swap are considered first, and then only are the floating payments considered. Yields on debt instruments of lower quality are expressed in terms of a spread relative to the default-free yield curve. The new version is more compact and, if you’d like additional help understanding the swap mechanics, I think this will be easier to follow. See yield curve, swaption, currency swap, notional, underlying, swap valuations in excel swap, legal settlement rate, and [Loan + Swap] rate. Return to Bob Jensen's main glossary on derivative financial instruments accounting --- http. The cash flows and values in Example 5, however, are developed from the prevailing upward sloping yield curve at each reset date. There are at least two methods of accomplishing this measurement. The payment (receipt) is equal to the variable LIBOR rate paid in the swap less the fixed rate received times the notional principle, or on 9/30/X1 (0.0556 0.0665)/4 x $10 million = ($27,250), a receipt. In the swap contract XYZ receives a fixed (6.65%) rate and pays a variable LIBOR rate on a notional principal amount of $10 million.

This method also could be referred to as the "theoretical swap" method (or "hypothetical derivative" method) because the comparison is between the hedged fixed rate on the debt and the current variable rate, which is the same as comparing cash flows on the fixed and variable rate legs of an interest rate swap. This is calculated (in the worked example) as the present value of the stream of future fixed cash flows. The relationship between spot rates and one- period forward rates is shown by the following formula. The accompanying Excel workbook used the tool Goal Seek in Excel to derive upward sloping yield curves and swap values at the reset dates that generated the $4,016,000 swap value used in the FASB's Example 1 of Section 1 of the FAS 138 examples at http. Nevertheless, we have discovered how the swap values on Page 75 of FAS 133 may have derived. Sample offer of employment letters sections offer of employment letter tips. For instance, in FAS 133, Example 2 beginning in Paragraph 111 illustrates a fair value swap valuations in excel hedge and Example 5 beginning in Paragraph 131 illustrates a cash flow hedge. The relationship between yields and time to maturity is often referred to as the term structure of interest rates. However, the table on page 75 of FAS 133 is incorrect, and the information provided in Example 5 on the derivation of swap values is incomplete. A portion of that example reads as follows. Unless the yield curve is flat, the comparison between the forward interest rate exposures over the life of the swap and the fixed rate on the swap will produce different cash flows whose fair values are equal only at the inception of the hedging relationship. Thus in Exhibit 3 the Interest accrued amount for 12/31/X1 is corrected to show the $350 amount. A good place to start in learning about how interest rate swaps work in practice is the CBOT tutorial at http. San diego worker s personal injury workers compensation settlement awards. We still see the need for proposing some corrections and explanations of the Page 75 results. At the inception of the hedge, the fair value of the fixed rate payments on the interest rate swap will equal the fair value of the variable rate payments, resulting in the interest rate swap having a fair value of zero. For example, the "one-year forward curve" tells you what the current yield curve is predicting the same curve will look like in one year. Embedded in the current yield curve are forward curves of various forward times. As shown in Exhibit 4, the 7/1/X1 the initial sum of the present values of the eight expected swap cash flows is zero. Sample letter rent payment receipt download on gobookee net. It was published in the latest issue of Risk Magazine, and it was co-authored with John Ensminger and Lou Le Guyader. Following the release of FAS 138, the FASB issued some examples. Valuation and Pricing of swap valuations in excel Interest Rate Swaps. This rule of thumb allows attribution of the variability in swap rates in ways that are useful for hedgers. Accepting the swap values as correct does less damage to the table, thus we assume the Interest accrued amounts must be corrected. Hospital Debt In FloridaThis example is accompanied by an Excel workbook file 133ex05a.xls that can be downloaded from http. If that risk is eliminated, the enterprise would obtain an interest rate on its debt issuance that is equal to the one-year forward coupon rate currently available in the marketplace in three months. The key files on yield curve derivations are swap valuations in excel yield.xls, 133ex02a.xls, and 133ex05a.xls. Example 2 in Appendix B of FAS 133 assumed that a flat yield curve prevails at all levels of interest rates. Paragraph 18 beginning on Page 9 of FAS 133 rules out hedges such as interest rate swaps from having a longer maturity than the hedged item such as a variable rate loan or receivable. For example, a bank may offer a "savings rate" higher than the normal checking account rate if the customer is prepared to leave money untouched for five years. Credit Union ReposThat is, historically, short-term rates are somewhat lower than longer-term rates. A biweekly mortgage is a mortgage loan biweekly mortgage calc payment plan in which the borrower. This function Y is called the yield curve, and it is often, but not always, an increasing function of t. Sample letter salary loan deduction download on gobookee net free books and. We derived the LIBOR yield curve for 9/30/X1 using Goal Seek in the same manner as described above. The typical yield curve gradually increases relative to years to maturity. Double Wide FinancingIn the introductory Paragraph 111 of FAS 133, the Example 2 begins with the assumption of a flat yield curve. This allows investors to bet on the slope of the yield curve. The LIBOR rates in the upward sloping yield curves that were used to derive forward rates, future expected swap cash flows, and swap values at the reset dates are not given in the example. Future expected swap cash flows in Exhibit 4 are equal to the fixed rate received in the swap (0.0665/4) less the calculated forward rate times the notional principal. For example, an investor might arrange to borrow at six-month LIBOR but lend at the 10-year T-Bond rate, where interest rates are set twice each year. A yield curve is the graphic or numeric presentation of bond equivalent yields to maturity on debt that is identical in every aspect except time to maturity.

Market yields are converted to spot interest rates ( spot rates or zero coupon rates ) by eliminating the effect of coupon payments on the market yield. Paragraph 112 of SFAS 113 refers to the "zero-coupon method." This method is based upon the term structure of spot default-free zero coupon rates. Readers may download an Excel workbook, best read in Excel, with cell comments that compare the FASB's original Page 75 of FAS 133 with our corrected table from http. That is, in normal economic conditions short-term rates are somewhat lower than longer-term rates. This correction will have the least effect on valuation differences. The swap spread represents the credit risk in the swap relative to the corresponding risk-free Treasury yield. The term "swap spread" applies to the credit component of interest rate risk. The first paper on Example 2, which dealt with a fair value interest rate swap, was published in Derivatives Report, November 1999, pp. This difference is shown in the table below. 10 Year LoansAlso see my interest rate accrual comments my "Missing Parts of FAS 133" document. As in all other swaps, the swap is a portfolio of forward contracts. In that case, the appropriate hedging instrument would be a series of forward contracts each of which matures on a repricing date that corresponds with the occurrence of the forecasted transactions. The market rate that existed at the inception of the hedge is the one-year forward coupon rate in three months. For online sources, I recommend that you type in "deriving a yield curve" in the Exact Phrase box at http. You might try generating it from the Eurodollars futures market --- http. Note Example 1 in Section 2 of the FASB document entitled swap valuations in excel Examples Illustrating Applications of FASB Statement No. Over a year ago I posted a dilemma regarding valuation of interest rate swaps when I attempted to devise a valuation scheme to add to Example 5 in Appendix B of FAS 133 --- http. The expected cash flows of the interest rate swap and swap valuations in excel the related fair value amounts are shown as follows. A basis swap (or yield curve swap) is an exchange of interest rates at two different points along the yield curve. The Interest Accrued amounts on Page 75 of FAS 133 are not compatible swap valuations in excel with the swap value and LIBOR rates at the reset dates. Computing the change in cash flows based on the difference between the forward interest rates that existed at the inception of the hedge and the forward rates that exist at the effectiveness measurement date is inappropriate if the objective of the hedge is to establish a single fixed rate for a series of forecasted interest payments. Since the swap rate is the sum of the Treasury yield and the swap spread, a well-known statistical rule breaks its volatility into three components. The swap values at the reset dates are the present values of the future expected swap cash flows. In a coupon swap or fixed-floating swap, one party pays a fixed rate calculated at the time of trade as a spread to a particular Treasury bond, and the other side pays a floating rate that resets periodically throughout the life of the deal against a designated index. The introduction of one European currency went a long way toward reducing basis risk in Europe. Swaps are the most common form of hedging risk using financial instruments derivatives. |

Seminar Series

Credit and Finance In the NewsMay c ty to provide o coveroge of the following lease option homes 757o collector roods for eitherresidentiol.

As explained by the expectations hypothesis of the term structure of interest rates, the typical yield curve increases at a decreasing rate relative to maturity. For these solutions, I just created a new interest rate and currency swap spreadsheet engine. If the objective of the hedge is to obtain the forward rates that existed at the inception of the hedge, the interest rate swap is ineffective because the swap has a single blended fixed coupon rate that does not offset a series of different forward interest rates. Either the Interest accrued amounts or the swap values are incorrect. For an "advanced" actually just more mathematical treatment of the problem I recommend Interest Rate Option Models, Ricardo Rebonato. Van Horne Financial Market Rates and Flows, 5th Edition.

The third quarterly forward rate is 1.550%, and so forth.

This illustrates the concept of a "basis swap spread" arising from swapping notionals in different currencies. See FAS 133 Paragraph 68 for the exact conditions that have to be met if an entity is to assume no ineffectiveness in a hedging relationship of interest rate risk involving an interest-bearing asset/liability and an interest rate swap. It turns out the implementation of the Jarrow and Turnbill methodology was not correct. Forward yield (or swaps) curves are used to value many types of derivative financial instruments.

In the case of interest rate swaps, yield curves are also called swaps curves.

Yield curves are used by fixed income analysts, who analyze bonds and related securities, to understand conditions in financial markets and to seek trading opportunities. But the most important yield curve to derivatives salesmen is one you wont find in the financial pages --- the forward yield curve, or "forward curve." Actually, there are many forward curves, but all are based on the same idea. The spot rates are different but they actually have not changed. The Interest accrued on $73,800 on 3/31/X2 is 0.0556/4 x $73,800 or $1,026, not $1,210 as presented in the original table. A longer passage from Chapter 8 appears at http.

Smart Money Week

Thus, in this example where an upward sloping yield curve is assumed, we must be given the yield curves at each reset date in order to replicate the calculations in the example.

The University ForumThe swap cash flows are calculated in that same manner for each quarter throughout the life of the swap. In this paper we discuss and explain the table on page 75 of FAS 133 and correct the Interest accrued errors. In a basis swap or floating-to-floating swap is the swapping of one variable rate for another variable rate for purposes of changing the net interest rate or foreign currency risk. The above Example 5 has been modified somewhat by the March 3, 2000 FASB Exposure Draft No. I just uploaded a fresh round of market risk Practice Questions which include several swaps related questions. I ve recalculated the example in question on your web page and believe I ve resolved the difference. Legal Settlement Exit Value Amortization Rate Accounting for. Some finance textbooks cover the Bloomberg Terminal in theory but do not get into the practical applications via a Bloomberg Terminal --- http. Similarly, an unknown set of estimated LIBOR yield curves underlie the FASB swap valuations calculated in all FAS 133/138 illustrations.

|

|

|